Will Tariffs Spike the Price of Made-In-USA Skincare?

Straightforward answers from the founder of a small American-made Korean skincare brand

Hello, I’m Adeline. I write Ginseng & Tonic to deliver a straight shot of skincare & cultural analysis to your inbox most Sundays. Subscribe for deep dives into the intersections of skincare and culture from someone fed up enough with the industry that she started formulating her own products.

The beauty news headlines are alarming: “Trump tariffs send beauty industry into crisis mode,” “How much more expensive will beauty products get as tariffs take effect?” According to NielsenIQ data, only 7% of beauty and personal care products made in the USA are manufactured domestically. This means the vast majority of brands will see dramatic price increases once these tariffs take effect.

But what if your go-to skincare line is made in the USA? Unfortunately, “made-in-America” doesn’t mean “immune to tariffs.” American manufacturing today relies heavily on the global supply chain, which directly impacts production costs.

This dependence on overseas suppliers began more than 30 years ago with the 1992 signing of NAFTA (the North American Free Trade Agreement.) Although then-president Bill Clinton promised NAFTA would create “good paying American jobs,” the opposite happened. Companies quickly shifted their manufacturing outside of the U.S. — first to Mexico, then Central America, and eventually to Southeast Asia and other low-cost labor markets.

As American manufacturing moved offshore, even the production that remained in the USA became increasingly reliant on overseas components. After decades of offshoring, the label “made in the USA” has become partially an illusion, as virtually every American-made brand now depends on imported components or raw materials.

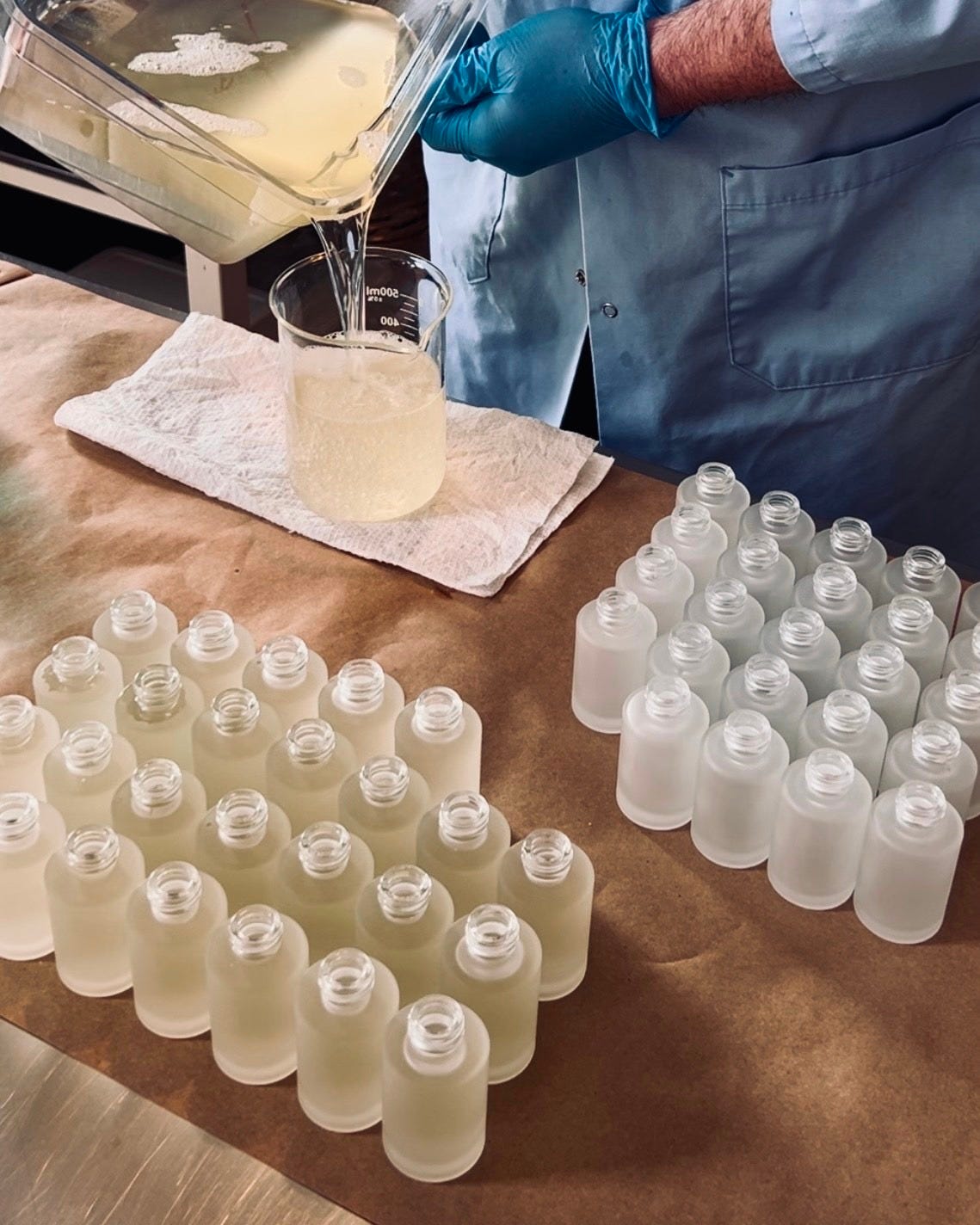

I know this firsthand as the founder, formulator and owner of Sabbatical Beauty, a Korean-inspired skincare brand produced in small batches by hand in my South Philadelphia lab. Despite our hyper-local production, many of our ingredients and packaging materials still come from abroad. Here’s why these new tariffs are bound to raise costs for my made-in-USA skincare brand—and likely your favorite brands as well.

American industry is dependent on the global supply chain

1. Cosmetic Packaging

Just about all glass and plastic cosmetic packaging is made in China. Even if you buy packaging from a U.S. based reseller, it likely originates in China. Right now, we’re looking at tariffs as high as 145%, so a container that costs $2 would encounter another $2.90 in tariffs, more than doubling its price to $4.90. While some European glass is available, it’s typically even pricier.

2. Mailer Packaging

We source our mailers from the US, but they are made using paper from Canada. Prices on these mailers have risen since January, and the tariffs are likely to push them even higher still.

3. Skincare Ingredients

Speciality ingredients — especially Asian botanical extracts — are commonly produced outside of the USA, because these plants are not native here. These ingredients will get hit with tariffs, driving up production costs for brands like mine who rely on them.

In fact, nearly all cosmetic raw materials will face substantial cost increases because of the tariffs. For example, my supplier sources their niacinamide from China and currently sells me a 5 pound bag for $120.

Making some assumptions about my supplier markup and if they do not absorb the tariff increase, a $120 bag may now cost me $294 — a 145% increase for me, a made-in-USA manufacturer.1 If half the ingredients (5 out of 10) in a skincare formulation are sourced from China and all ingredients have similar costs, the average cost of my entire formulation increases by approximately 72.5%.

For small, American-made manufacturers, these tariffs—supposedly intended to boost domestic production—are instead causing our costs to skyrocket, putting our very existence at risk. Ironically, measures claiming to stimulate American manufacturing may ultimately end up destroying many small American manufacturers.

Why sourcing within the USA is not always possible

American manufacturers normally demand large minimum order quantities and have higher tooling costs, both of which have driven small indie brands to source from overseas instead. Additionally, some types of cosmetic packaging or materials simply don’t exist at scale in the USA any longer.

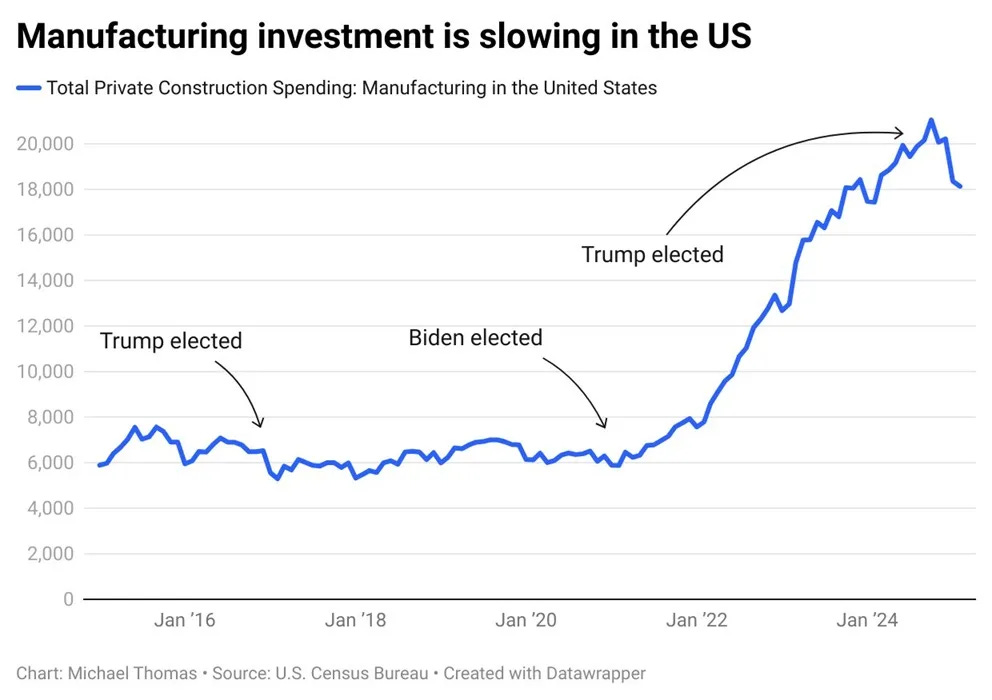

It’s also unlikely that we’ll see a surge in domestic manufacturing of the components small indie brands will need. Trump is canceling Biden’s industrial policies, and factory construction is slowing down under the current administration:

The beauty industry isn’t an outlier. Fashion brands are facing similar challenges. The Business of Fashion reports that the tariffs won’t kill fast fashion — but indeed might kill sustainable fashion. Tariffs affect any business that includes imported materials or components in its systems.

Why some made-in-USA skincare brands aren’t raising prices

You might notice certain American-made beauty lines aren’t increasing prices — or are even saying they’ll lower them. How are they managing this?

Economies of scale: These brands may be large enough to absorb additional costs, or be able to place large enough minimum orders to shift some of their sourcing domestically

Ability to locally source ingredients: The brands may be using more natively available raw materials than other brands

Sacrificing margins for competitiveness: They may be choosing to eat into their margins for the moment to win market share

Or, they may also have not realized completely how their process still depends on some overseas components, and we may see a reversal in the future. Most made-in-USA indie brands have been indicating that they are still dependent on the global supply chain and unsure yet if they can fully absorb the increased costs.

Will Sabbatical Beauty Raise Its Prices?

Right now, I don’t know. Sabbatical Beauty is already priced as a prestige line, and I’m reluctant to increase costs for my customers. That decision hinges on the final tariff rates and how much our production expenses climb. Like every other business, we’re waiting to see what happens. If the increases are too steep, we may have no choice but to adjust our pricing—but I’ll be doing everything I can to minimize that.

In short, don’t assume buying American-made beauty products shields you from tariff-driven price hikes. Global supply chains, limited domestic sourcing and hefty tariffs mean ‘Made in the USA’ brands are barely in the clear. As the situation evolves, you will want to prepare yourself for potential price changes in your skincare routine—no matter where that product’s label says it was made.

Enjoyed this Substack? I post most Sundays.

You may also like:

How Much Niacinamide Should You Use? Borrow Everything I Know As Someone Who Makes Skincare

How to Read an Ingredient List Like Someone Who Makes Skincare

From Literature to Lotions: How I Went from Comparative Literature PhD to Skincare Formulator

There are several assumptions in this calculation. First, I assume that my niacinamide supplier’s markup is 75%, a common markup percentage for consumer packaged goods. With a 75% markup, a bag of niacinamide that sells for $120 costs the supplier $30. With the new tariffs of 145%, they’ll pay an additional $43.50 (145% of $30), increasing their total cost to $73.50.

Next, assuming my supplier maintains the same 75% markup, the bag of niacinamide I previously purchased for $120 will now cost me $294 — a 145% increase for me, a made-in-USA manufacturer.

There are two assumptions working in this projection: (1) that my supplier’s markup is accurate and (2) that my supplier does not absorb some of the additional costs of the tariffs, and passes along these costs to their customers. Both of these assumptions may or may not be true.

Appreciate your honesty at the end. Are you going to raise your prices? You don’t know! It’s such a tough thing to call and I know many other founders are feeling the same way, even if unspoken. What a tough spot to be in right now in beauty.

Thanks for sharing your experience and breaking down how these kinds of policies hit small businesses the hardest. And, unfortunately, tariffs are just one piece of the puzzle….there are a bunch of other politic and economic moves that could make things even tougher for small brands and squeeze consumers' already limited spending power. I hope you find a path through this and come out even stronger on the other side.